Measuring Success in Accounts Payable Process Improvement

- russellcashfin

- Jul 16, 2025

- 3 min read

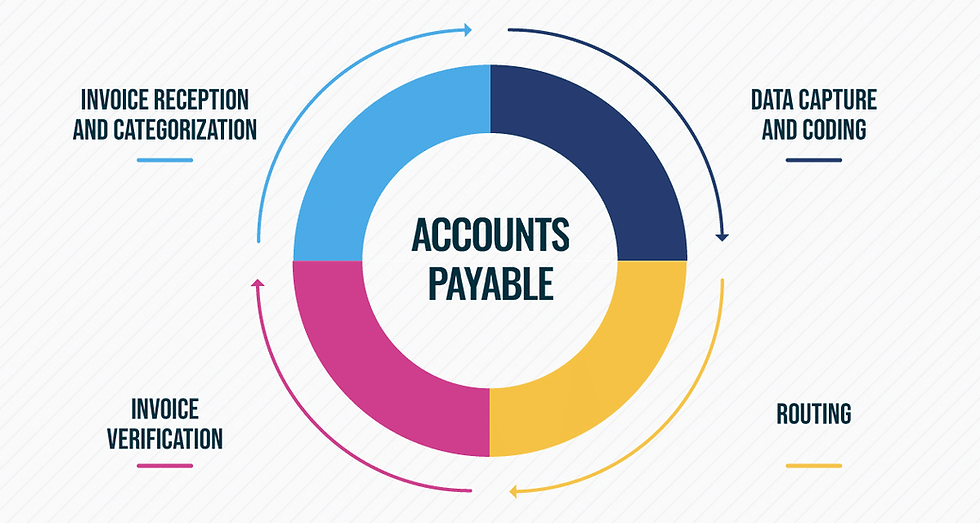

Accounts payable (AP) is a core financial function that directly impacts an organization’s cash flow, vendor relationships, and compliance. While many companies invest in streamlining their AP workflows, few track whether these improvements are truly delivering results. Measuring success in accounts payable process improvement is not just about faster invoice approvals—it’s about achieving long-term financial efficiency and control.

In this blog, we’ll break down the key performance indicators (KPIs) and strategies to effectively measure AP process success and ensure your automation efforts are paying off.

Why Measuring AP Process Improvement Matters

Improving the accounts payable process without measuring outcomes is like driving with your eyes closed. Businesses that track the right metrics gain valuable insights into:

Cost savings and process efficiency

Supplier satisfaction

Error rates and compliance issues

Return on investment (ROI) from automation

By identifying what’s working (and what’s not), you can make informed decisions and continue optimizing your workflow.

Key Metrics to Track AP Process Improvement

To truly understand whether your AP process is improving, monitor the following KPIs consistently:

1. Invoice Processing Time

This measures the time taken from receiving an invoice to issuing payment. Shorter processing times indicate improved efficiency. With automation, companies often reduce processing time from weeks to just a few days or even hours.

2. Cost Per Invoice

Manual AP processing can be costly due to labor, paper handling, and error correction. Automation significantly lowers the cost per invoice. According to industry benchmarks, best-in-class AP departments process invoices for under $2 each.

3. Invoice Exception Rate

Exceptions slow down AP workflows and often result from missing data, mismatched purchase orders, or manual entry errors. A decreasing exception rate suggests better data quality and improved validation systems.

4. On-Time Payment Rate

Late payments can damage supplier relationships and result in missed early payment discounts. An improved AP process should result in more on-time payments and stronger supplier trust.

5. Duplicate Payment Rate

This metric reveals how often duplicate invoices are paid. With a robust system in place, these errors should be minimized or eliminated entirely.

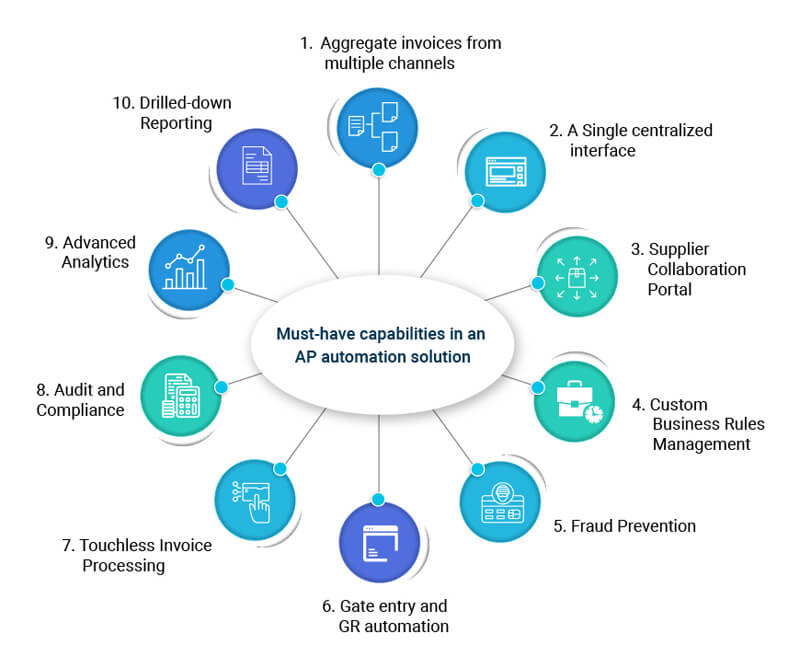

Tools to Support Measurement and Reporting

Improving the AP process is one thing; consistently measuring performance is another. The right workflow automation tools—such as Cflow—can help finance teams track and analyze every step of the process. These tools offer dashboards and real-time data that make it easy to monitor KPIs, detect inefficiencies, and generate audit-ready reports.

Workflow automation also integrates with ERP and accounting software, reducing data silos and providing accurate insights into performance.

Best Practices to Ensure Measurable Improvement

To drive measurable success, follow these best practices:

Set clear benchmarks before implementing changes

Automate manual tasks to reduce errors and delays

Continuously monitor KPIs and share insights with stakeholders

Train your team on new systems and encourage compliance

Gather feedback from vendors and internal users

With these steps, you ensure your AP process isn’t just improved—it’s consistently improving.

Final Thoughts

Measuring success in accounts payable process improvement requires a clear understanding of your current performance, the right KPIs, and tools that provide visibility. It's not just about faster payments or lower costs—it's about building a sustainable, efficient, and error-free process that supports your organization's broader financial goals.

By focusing on data-driven improvement, businesses can turn accounts payable from a cost center into a strategic advantage.

SITES WE SUPPORT

SOCIAL LINKS

Comments