Manual vs Automated Accounts Payable Process: Which Is Right for You?

- russellcashfin

- Jul 16, 2025

- 2 min read

The accounts payable (AP) process plays a crucial role in maintaining healthy cash flow and vendor relationships. But as businesses grow, they often face a critical decision: Should they stick with a manual accounts payable process or shift to automation?

Understanding the strengths and limitations of both approaches helps determine the best fit for your business operations.

What Is the Manual Accounts Payable Process?

A manual accounts payable process relies heavily on paper-based documents, spreadsheets, and human oversight. Tasks such as invoice data entry, validation, approvals, and payment scheduling are handled manually by the finance team.

While this method can work for smaller businesses with limited invoices, it often becomes inefficient and error-prone as volume increases.

Challenges of Manual AP:

Time-consuming and repetitive tasks

Higher risk of human error

Poor visibility into invoice status

Risk of late payments or missed deadlines

Difficulty scaling with business growth

What Is Accounts Payable Automation?

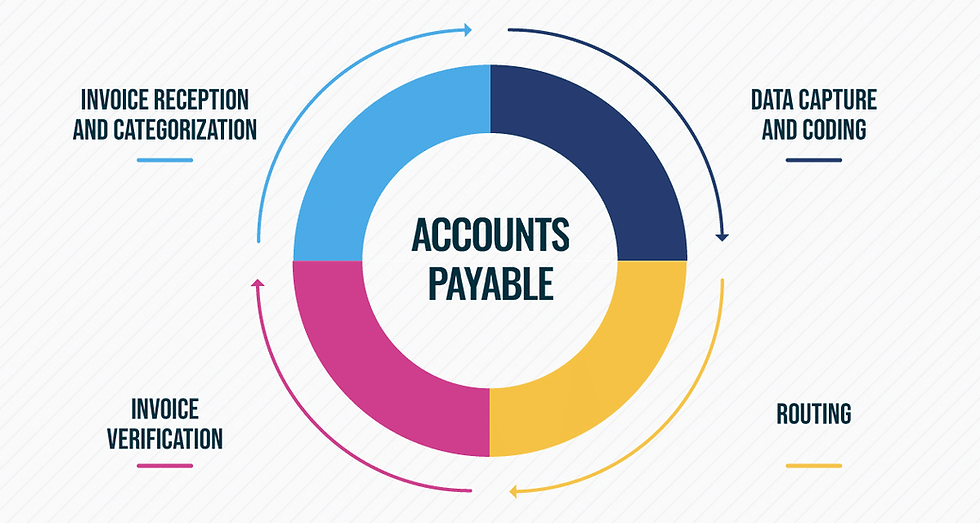

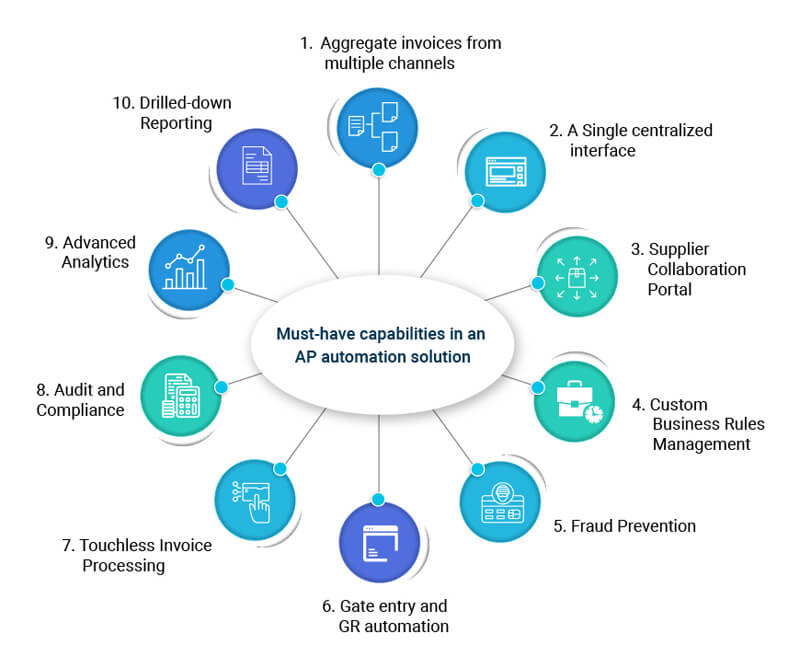

Accounts payable automation uses software to streamline and digitize the entire invoice-to-payment process. With automation, invoices can be captured, validated, routed for approval, and scheduled for payment — all without manual intervention.

Tools like Cflow offer no-code workflow automation solutions designed to optimize AP processes and improve accuracy.

Benefits of AP Automation:

Faster invoice processing and approvals

Reduced manual data entry and errors

Better compliance and audit trails

Real-time tracking and reporting

Improved vendor relationships with on-time payments

Key Differences: Manual vs Automated AP

Feature | Manual AP | Automated AP |

Speed | Slow and labor-intensive | Fast and streamlined |

Error Rate | High (due to manual entry) | Low (AI/ML-enabled validation) |

Scalability | Difficult to scale | Easily scalable |

Cost | Higher long-term labor costs | Lower processing costs over time |

Visibility | Limited reporting & tracking | Real-time insights and dashboards |

Which Is Right for You?

The right choice depends on your business size, invoice volume, and growth goals.

Choose Manual AP If:

You’re a small business with very few invoices

Your team can handle AP without delays

You prefer a low-tech approach for now

Choose Automated AP If:

You process large volumes of invoices monthly

Your team spends too much time on repetitive AP tasks

You want better visibility, control, and compliance

Automation is particularly beneficial for growing businesses that need to optimize operations, reduce costs, and ensure timely payments.

Final Thoughts

Sticking with a manual accounts payable process may seem cost-effective at first, but it often leads to delays, errors, and scaling issues. On the other hand, automation not only reduces the workload on your finance team but also brings speed, accuracy, and efficiency to the entire process.

If your business is ready to modernize its AP workflow, investing in accounts payable automation could be the strategic move that drives growth and profitability.

SITES WE SUPPORT

SOCIAL LINKS

Comments