How Accounts Payable Automation Saves Time, Money, and Headaches

- russellcashfin

- Jul 16, 2025

- 3 min read

Managing accounts payable (AP) manually is often time-consuming, error-prone, and expensive. In a business environment where efficiency and accuracy are non-negotiable, accounts payable automation is becoming a strategic advantage rather than just a back-office upgrade. By automating the AP process, businesses can reduce costs, improve cash flow, and eliminate many of the common headaches associated with manual invoice handling.

Let’s explore how AP automation saves time, money, and stress—and why it’s a smart investment for growing companies.

Time-Saving Benefits of Accounts Payable Automation

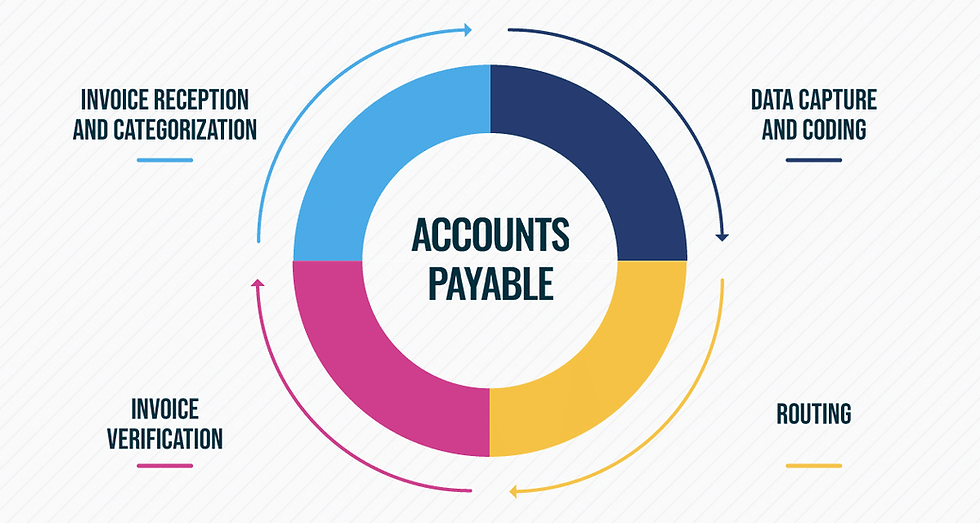

One of the most immediate benefits of automating accounts payable is the drastic reduction in manual data entry. Traditional AP processes require employees to receive invoices, enter data into systems, match invoices with purchase orders, and get approvals—often across departments. This not only slows down the cycle but also leads to delays in payments and vendor relationships.

With AP automation software, invoices are captured electronically, matched with POs, and routed for approval automatically. This minimizes manual intervention and reduces invoice processing time by up to 70%. Faster processing also means your team can focus on strategic financial tasks rather than chasing approvals and correcting errors.

Cost Savings Through AP Automation

Every manual invoice costs money—anywhere from $10 to $25 per invoice, according to industry reports. That cost includes labor, paper, printing, mailing, and storage. Add late payment fees, missed early payment discounts, and potential fraud, and the expense grows significantly.

Accounts payable automation eliminates most of these costs. Digital workflows replace paper, reduce administrative overhead, and cut down on delays. Automated systems also provide better visibility into payment cycles, helping businesses capture early payment discounts and avoid penalties. Over time, these savings can significantly improve your bottom line.

Additionally, automation helps prevent duplicate payments, overpayments, and fraud—financial risks that are common with manual processes.

Fewer Headaches, Better Accuracy

Manual AP processes are not only slow and costly but also error-prone. Typos in invoice entries, lost paperwork, and misrouted approvals can all create unnecessary stress for finance teams.

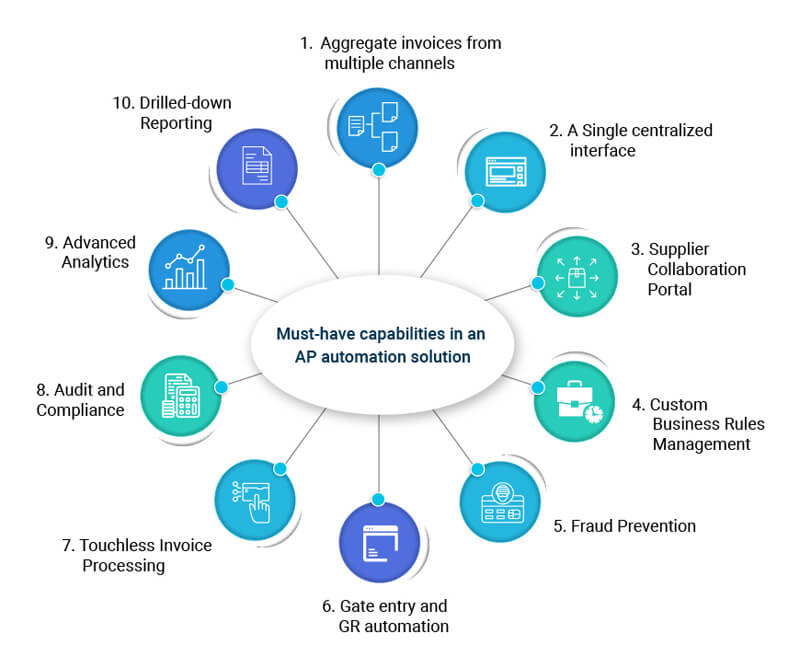

With AP automation, data accuracy improves significantly. Invoice data is extracted using OCR (optical character recognition), cross-checked against purchase orders, and automatically flagged for discrepancies. Alerts and reminders keep the process moving, and built-in approval hierarchies ensure nothing slips through the cracks.

Automated systems also provide audit trails and compliance support, which reduces the burden of reporting and financial audits. For CFOs and controllers, this transparency adds peace of mind.

Better Vendor Relationships and Business Agility

Vendors appreciate timely, accurate payments. By automating your AP process, you build trust with suppliers, reduce back-and-forth communication, and gain a stronger negotiating position. Happy vendors may offer better terms or prioritize your business over others.

In addition, automation provides real-time insights into cash flow, outstanding invoices, and financial liabilities—giving leadership the ability to make smarter, faster decisions.

Final Thoughts

In a world where digital transformation is reshaping every business function, accounts payable automation is no longer a luxury—it’s a necessity. By investing in the right AP automation solution, companies can save time, cut costs, and eliminate the everyday frustrations that plague manual processes.

Whether you’re a small business or a growing enterprise, the benefits of AP automation extend across your entire finance operation—turning what was once a pain point into a competitive advantage.

SITES WE SUPPORT

SOCIAL LINKS

Comments