From Chaos to Clarity: Transforming Your AP Process Step by Step

- russellcashfin

- Jul 16, 2025

- 3 min read

Managing accounts payable (AP) is one of the most critical yet complex functions in any finance department. When manual processes, lost invoices, or delayed approvals take over, chaos can easily creep in—impacting cash flow, vendor relationships, and compliance. Fortunately, modern businesses are now turning to structured strategies and automation to drive accounts payable process improvement.

Here’s how you can transform your AP process from disorganized to efficient, one step at a time.

Step 1: Assess the Current Accounts Payable Process

Before making any improvements, it’s crucial to map out your existing AP workflow. Where are the bottlenecks? Are invoices getting stuck in approvals? Are manual data entries leading to frequent errors? Identifying the weak links gives you a solid starting point for redesign.

A detailed audit also helps uncover hidden costs, such as late fees, lost discounts, or the time spent chasing down paperwork. This clarity is key to aligning your process with business goals.

Step 2: Standardize and Document Workflows

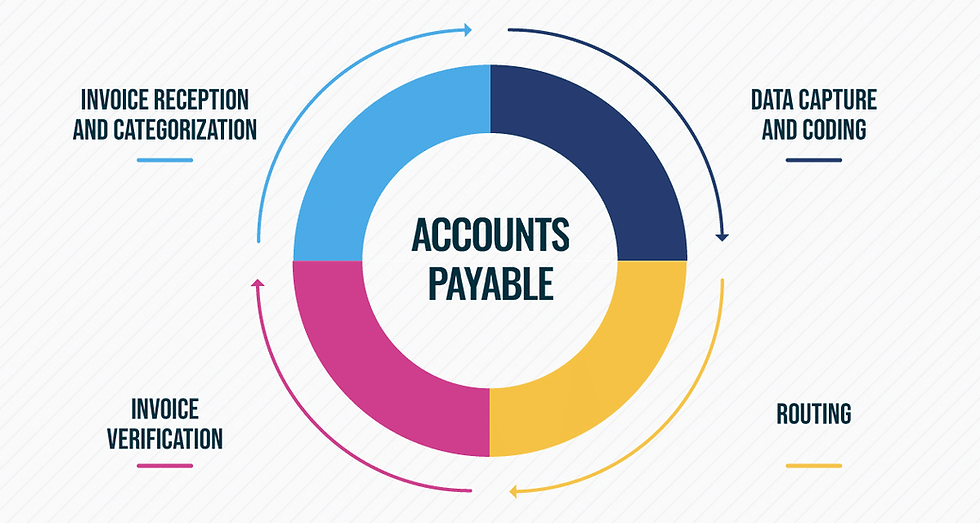

One of the fastest ways to reduce AP chaos is by standardizing your invoice and payment workflows. Create documented steps for invoice receipt, validation, approval, and payment. This not only improves visibility but also ensures consistency across departments.

Documented workflows make it easier to train new team members and maintain compliance with internal and external audit requirements.

Step 3: Introduce Digital Invoicing

Relying on paper-based invoices or PDF attachments leads to delays and disorganization. Digital invoicing systems allow vendors to submit invoices through a portal or electronic data interchange (EDI), which eliminates manual handling and improves data accuracy.

Digitization helps centralize invoice data, reducing the chances of duplicate payments and improving overall process transparency.

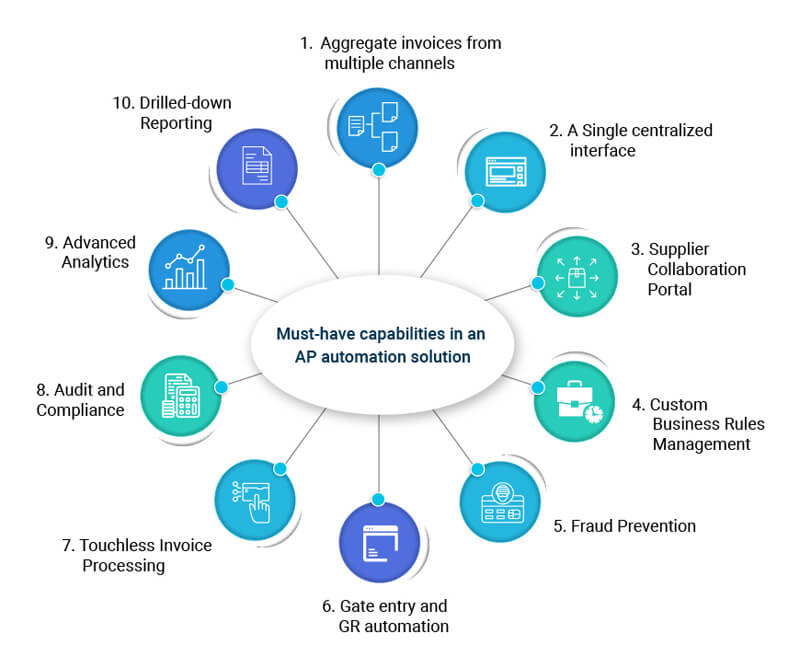

Step 4: Automate Repetitive Tasks

Automation is the key to accounts payable process improvement. Modern AP automation tools can handle everything from invoice capture and data extraction to three-way matching and automatic approvals based on pre-set rules.

By reducing manual input, you speed up processing times, minimize errors, and free up your team for higher-value tasks like vendor management and financial analysis.

Step 5: Implement Approval Workflows

One common source of AP delays is waiting for invoice approvals. With workflow automation, you can create dynamic approval hierarchies that route invoices to the right people based on department, amount, or priority.

Automated reminders and escalations help ensure timely approvals, which improves vendor relationships and may even unlock early payment discounts.

Step 6: Integrate with Accounting Systems

A well-optimized AP process should connect seamlessly with your ERP or accounting software. This integration ensures that all financial data stays consistent, up-to-date, and ready for reporting.

Integration also helps with real-time tracking of payables, improving cash flow visibility and making month-end closing faster and more accurate.

Step 7: Monitor, Measure, and Improve

Even after transforming your AP process, the work doesn't stop. Establish key performance indicators (KPIs) such as invoice processing time, error rate, and cost per invoice. Use dashboards to monitor performance and continuously identify areas for improvement.

Regular process reviews ensure that your AP function evolves with changing business needs and compliance regulations.

Final Thoughts

Improving your accounts payable process doesn’t happen overnight, but with a step-by-step approach, it’s absolutely achievable. By embracing automation, standardization, and digital workflows, businesses can turn their AP departments from a source of stress into a hub of strategic value.

From chaos to clarity—accounts payable process improvement is not just about fixing what’s broken; it’s about building a smarter, faster, and more resilient financial operation.

SITES WE SUPPORT

SOCIAL LINKS

Comments