How to Optimize Your Accounts Payable Process Without Overhauling Everything

- russellcashfin

- Jul 16, 2025

- 3 min read

Accounts payable (AP) is one of the most critical functions in any finance department, yet it often suffers from inefficiencies, manual errors, and time-consuming workflows. Many businesses hesitate to improve their AP process because they believe it requires a complete system overhaul. The truth is—you can optimize your accounts payable process significantly with small, strategic changes that don’t disrupt your entire operation.

Here’s how to streamline your AP process without tearing everything down.

1. Start with a Process Audit

Before making any changes, take a close look at your current accounts payable process. Identify:

Where delays happen (e.g., invoice approvals, data entry)

Common sources of errors

Manual touchpoints that could be reduced

Mapping your workflow from invoice receipt to payment helps pinpoint bottlenecks and areas for improvement. You don’t need to rebuild the entire process—just fix what’s slowing it down.

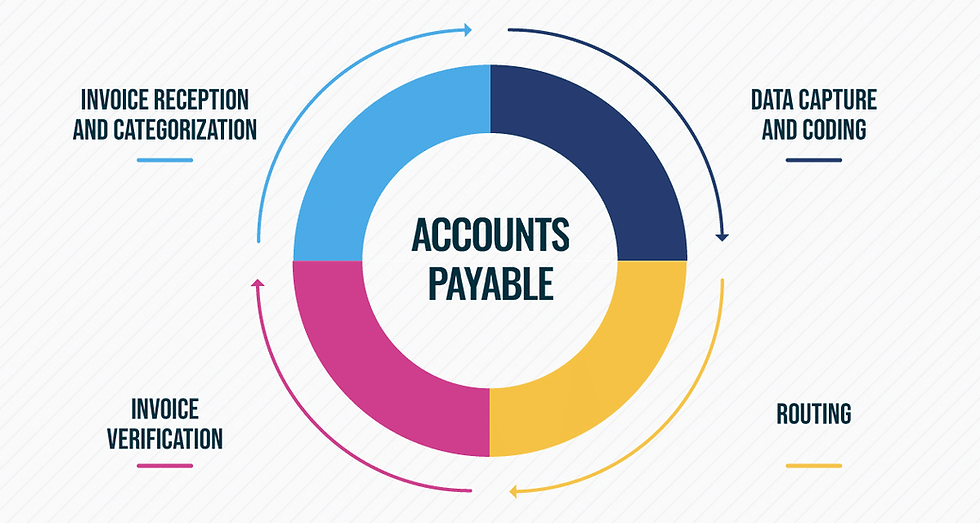

2. Standardize Invoice Handling

One of the quickest wins in optimizing AP is creating a standardized invoice intake process. Whether you receive invoices via email, physical mail, or through vendor portals, create a single method for capturing and storing them digitally.

Use email filters or a centralized inbox for receiving invoices, and apply consistent naming conventions and data fields. Standardization makes future automation easier and ensures no invoice slips through the cracks.

3. Introduce Approval Workflows

Manual approval processes often delay payments and cause frustration. Rather than chasing signatures or waiting for emails, implement simple workflow automation tools that route invoices to the right people based on predefined rules.

You don’t need to invest in expensive enterprise software. Tools like Cflow allow you to build no-code approval workflows that notify stakeholders and track invoice status in real-time, reducing delays and improving accountability.

4. Go Paperless (If You Haven’t Already)

Going paperless is one of the lowest-effort, highest-impact improvements. Use digital invoice capture tools or even simple PDF storage systems in the cloud to keep your documents organized and accessible. This also reduces the risk of losing critical information and makes audits easier.

5. Set Clear Payment Schedules

Late payments can damage vendor relationships and cost you money in late fees. On the other hand, paying too early affects cash flow. The solution? Clear, consistent payment schedules.

Use AP software or accounting tools to set up automated reminders and batch payments on specific days. This keeps your payments predictable and improves cash flow forecasting.

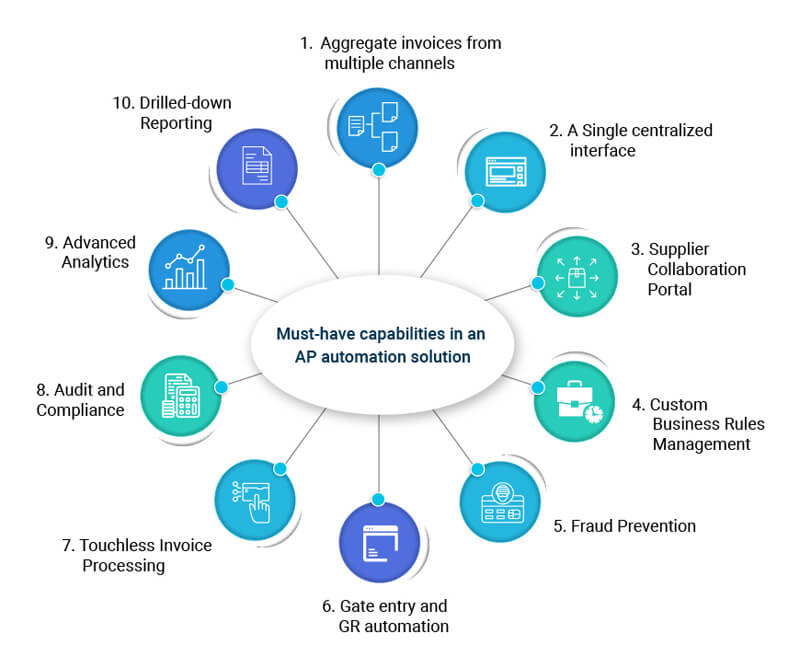

6. Leverage Basic AP Automation

You don’t need to automate everything at once. Start with small, high-impact tasks like:

Automatic data capture from invoices (OCR)

Pre-built email templates for payment confirmations

Reminder notifications for pending approvals

Even these minor changes can significantly reduce manual effort and error rates.

7. Train Your Team

Optimization isn’t just about tools—your team plays a huge role. Provide basic training on the updated process, educate them on the benefits of automation, and ensure everyone follows the same steps.

A well-trained AP team ensures consistency, compliance, and efficiency without needing constant oversight.

Final Thoughts

Optimizing your accounts payable process doesn’t require a massive digital transformation. By auditing your current workflow, eliminating bottlenecks, and introducing targeted automation tools, you can create a faster, more accurate, and more cost-effective AP function.

Small changes lead to big gains—and with the right strategy, you can modernize your AP process without disrupting your business.

SITES WE SUPPORT

SOCIAL LINKS

Comments